by Nedamer Bajal, 01/19/2012 SHAZAM AND HIS ASSOCIATES ARE Great. I retained Shazam for my case as well as a probation Violation due to my new demand. My rates have been dismissed, and my probation was re-instated, and I in no way had to look in Court. I'd recommend this Lawyer to everyone. Shazam and his Personnel are the ideal, and treat you not being a prison, but a vital individual that they want to enable. by Eli Strausman, 01/eleven/2012 Excellent get the job done! Not content which i experienced to rent an attorney, but on reflection it was worth it. Many thanks Deb for your professionalism and support. Near

For those who have exceptional unpaid personal debt, creditors may well search for to obtain your wages garnished. Wage garnishment is when part of your income is sent directly to a creditor before you decide to get paid. Even though wage garnishment is lawful, there are ways you'll be able to stop the method.

Chat with Licensed legal professionals right until you’re contented. About any legal concern—from significant to small, and anything between.

If you believe the judgment was produced in mistake or it’s triggering undue hurt to the finances, you'll be able to obstacle the garnishment.

In the event you owe taxes into the Condition of Maryland, your wages is usually hooked up in accordance with the income lien provision of Maryland regulation. Look into the Maryland Comptroller's Site For more info.

What exactly is the maximum time I can hold out just before I file a garnishment continuing soon after I get a judgment? Garnishment proceedings is often filed quickly In case the judgment is a default judgement. A garnishment can only be submitted Should the default judgment is not in outcome inside 10 (10) small business times.

The creditor can accumulate the credit card debt once the court has entered a judgment. Creditors can garnish wages, lender accounts, and attach another assets. Your wages is probably not garnished by a creditor much more than 25% for each spend period of time.

Garnishment is also referred to as a wage attachment. It is a court docket buy that permits creditors to acquire dollars right out of one's paycheck.

Creditors can garnish your paychecks when you slide driving in payments. If you're not like the majority of people, on the other hand, you may not be able to totally grasp the intricacies behind wage garnishment.

If your judgment debtor wants to item or elevate exemptions into the garnishment, she or he really should do this inside of thirty times from the financial institution staying served with the Writ of Garnishment.

A judgment for revenue is really a lien that covers the judgment volume and any fascination soon after it has been paid.

Because 1988, all court orders for child assist involve an computerized profits withholding buy. Another mum or dad could also get yourself a wage garnishment order in the court if you get at the rear of in baby assist payments.

There's no these types of limitation on directing the monetary institution to provide the dollars to the judgment creditor. Financial institution Garnishment Timeline What Cannot be Garnished?( Exemptions from Monetary Institution Garnishment )Profit a price savings account may be secured from garnishment. This is termed an exemption. If the court docket grants an exception, revenue becoming held because of the garnishment is returned to you personally. Ask for an exemption within 1 month of once the writ of garnishment was served within the financial institution. Use the shape Motion for Release of Creating from Levy/Garnishment (DC-CV-036). When will the court docket give an exemption?-- To ensure that the court docket to approve an exception for your price savings account you need to point out a lawful rationale from point out or governing administration regulation with the exception. Below are supplied essentially the most standard lawful causes for your court to deliver an exception. If you are not confident no matter if you receive an exception, seek advice from with an attorney. Underneath Maryland legislation, you are able to request an exception of just as much as£6,000 for any variable. See Maryland Annotated Code, Courts together with Judicial Proceedings § 11-504(b)(5). Other premises for an exception are according to in which you acquired the money. You may perhaps get authorized for an exception When the cash in your checking account originated from certainly one of the next assets: Social Basic safety rewards (Incapacity and retirement)Veterans pros and other governing administration pros pointed out beneath. Child support Point out public assistance Positive aspects(BREEZE, TCA, and so on)Accredited retired lifestyle Added benefits (401k, Personal RETIREMENT ACCOUNT, pension designs)Staff Payment Joblessness Insurance policy policyAlimony Sometimes, the fiscal establishment may well minimize to freeze legally secured money from the above mentioned listing. When this get more info requires location, the financial institution will definitely inform you Because the wage garnishment laws in Maryland are so rigorous concerning the grounds on which an exemption might be granted, the only real option for A lot of people will be to file for bankruptcy. When you've submitted for individual bankruptcy, creditors should quickly stop all wage garnishments.

To “garnish” is always to choose home (most frequently a percentage of somebody's wages or fork out) by courtroom get. Garnishment is a continuing by a creditor to gather a debt by getting the assets or assets of a debtor. Any person or business enterprise may be subject matter to garnishment.

Edward Furlong Then & Now!

Edward Furlong Then & Now! Rider Strong Then & Now!

Rider Strong Then & Now! Alexa Vega Then & Now!

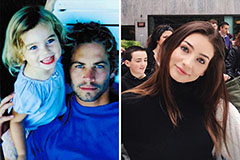

Alexa Vega Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now! Nadia Bjorlin Then & Now!

Nadia Bjorlin Then & Now!